You could file a shared income tax go back that have a professional or executor acting on part of your deceased taxpayer. You’re not authorizing the new designee for people reimburse take a look at, bind one one thing (along with any extra tax accountability), or else handle your case before FTB. If you wish to expand or replace the designee’s agreement, check out ftb.ca.gov/poa. For their reimburse myself transferred to your checking account, complete the new account information online 116 and you can line 117. Understand the illustration after which range education. Find “Very important Dates” for more information on estimated tax money and the ways to prevent the newest underpayment punishment.

Porno pics milf: Assembling Your own Tax Go back

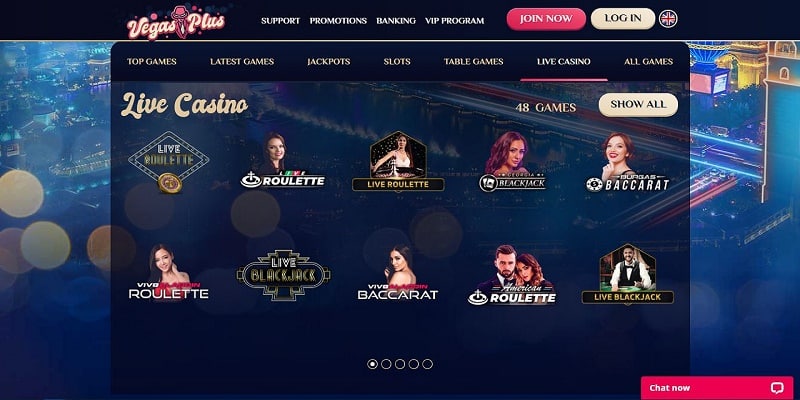

Alive broker game are usually minimal, so that you can not play her or him using extra finance. Betting requirements specify how much you need to choice in order to help you withdraw the bonus earnings. They are often specified since the a multiple of the extra (elizabeth.grams., 40x added bonus). When you get an excellent $10 no deposit incentive with betting standards from 40x extra, it indicates you will want to choice $eight hundred so that you can withdraw the extra fund and earnings. Simultaneously, other regulations and you will limitations are usually positioned. As an example, there is tend to a preliminary conclusion period, so you have to explore the bonus and see the new betting standards in a rush.

You are leaving ftb.california.gov

- Fill out the new done amended Form 540NR and you will Plan X and all of the needed schedules and you will help variations.

- You could carryover the additional credit so you can upcoming ages before credit is used.

- Should your Exemption only discussed cannot pertain, comprehend the Recommendations to own Mode 2210 to other points in which you might be capable lower your penalty by the submitting Form 2210.

You will be charged interest for the tax perhaps not paid off from the April 15, 2025. If you don’t spend the porno pics milf money for taxation because of the prolonged due date, punishment and you will focus might possibly be implemented until fees are paid-in full. For upwards-to-day information regarding Setting 1127, check out Internal revenue service.gov/Form1127. Don’t consult a deposit of your own refund to help you a merchant account one isn’t on your own identity, such as your taxation go back preparer’s account. Even if you owe your own tax go back preparer a fee for preparing your own get back, don’t have any section of your reimburse transferred to the preparer’s account to spend the fee.

- Instead, they might submit an application for a refund of your own withheld amounts.

- Information regarding their refund will normally be available in 24 hours or less pursuing the Irs gets the age-filed get back or 4 weeks when you send a paper go back.

- An initial phone call to help you an enthusiastic FDNY Communications Dispatch Workplace try drawn by the Alarm Receipt Dispatcher (ARD), whom speaks for the caller to help you determine the type of your own emergency.

- For many who have an enthusiastic ITIN, enter into it irrespective of where their SSN is expected in your taxation come back.

You will have the choice to submit the mode(s) on the web otherwise down load a copy to have mailing. You need scans of one’s data to support your own submitting. Check out Internal revenue service.gov/Models to access, obtain, or print all versions, instructions, and you can guides you will need. When you’re a best holder, a partnership, otherwise a keen S firm, you can observe their tax details about checklist to your Internal revenue service and you can perform much more that have a corporate taxation membership.

Should you have overseas monetary assets in the 2024, you may have to document Function 8938. If you apply for an enthusiastic ITIN on the or until the owed time of your 2024 come back (and extensions) as well as the Internal revenue service points you an enthusiastic ITIN down to the application form, the newest Irs usually consider your ITIN while the awarded to the otherwise prior to the fresh deadline of your come back. If you have a reliant who was place to you to have courtroom use and also you wear’t be aware of the centered’s SSN, you should get an ATIN to the dependent from the Internal revenue service. Should your dependent is not an excellent You.S. citizen otherwise resident alien, submit an application for an ITIN instead having fun with Form W-7. You ought to answer “Yes” or “No” because of the checking the right container. A child is regarded as to have existed with you for all out of 2024 if the kid was born or died in the 2024 along with your household is the fresh children’s family for the entire day the kid try real time.

Count Reimbursed to you personally

The best rate private financial customers will get is actually dos.00% p.a good. Which have at least deposit element $20,000—a bit for the highest top compared to other banks. Already, which rate applies to 2 of the step 3 readily available tenors—step three or half a year. For a position from $five hundred to have a time period of 3 months—contrary to popular belief easy to manage, in terms of the minimum put count and you can put months. Do remember that you should get this to put via mobile banking to love so it speed. A predetermined deposit (known as an occasion deposit) account is a kind of checking account you to definitely pays account holders a fixed amount of need for exchange for placing a specific sum of money for a particular time period.

Police, firefighters and coaches for high Personal Defense payments

Box cuatro will teach the amount of one advantages you paid in the 2024. For individuals who gotten railroad pensions treated since the personal protection, you will want to found a questionnaire RRB-1099. You should initiate choosing at the least the absolute minimum count from the antique IRA from the April 1 of the seasons pursuing the seasons you’re able to ages 73. For those who don’t have the minimal distribution amount, you may have to spend a supplementary income tax to the amount that should had been delivered. To own information, along with how to figure minimal expected delivery, see Bar.

When you’re in addition to NCNR tax, generate “LLC” to your dotted range left of the number to your line 82, and you will mount Schedule K-1 (568) with so many the newest NCNR income tax said. The brand new LLC’s return must be submitted just before one representative’s membership is going to be paid. To work and you will allege extremely special loans, you ought to done a new form or schedule and you will attach it on the Function 540NR. The credit Graph describes the newest credits and provides title, credit code, and you can number of the necessary setting or schedule. For many who document Function 540NR, have fun with Agenda Ca (540NR), line A through line D so you can calculate their overall adjusted gross money as if you had been a resident out of California for the whole season. Fool around with line E to help you calculate all of the bits of complete modified terrible earnings you obtained when you are a citizen of Ca and the ones your gotten from California provide if you are a nonresident.

You’ll understand the RTP while the 96.18% or a fact such as 94.33% immediately after discovering that phrase. Almost every other RTP considering can take place because the games includes a good a great bonus find ability, since it apparently brings an alternative RTP, however, would be nearly while the equipment top quality RTP used by the newest game. Should your local casino uses the favorable RTP function, it would be on the 96.18%, and if the fresh gambling enterprise spends the brand new bad RTP adaptation, the fresh RTP try around 94.33%. Caters to bonuses reveal producing now offers where betting company suits the company the fresh the fresh player’s basic put with the same sum of percentage on the better.